Natural gas – a foundational fuel for the future

SUMMARY

Natural gas producers are working on a number of fronts to ensure natural gas remains reliable, affordable, and a low-emission source of energy, all key to a secure energy future. [Image credit: Seneca Resources/MiQ]

By Dale LunanPOSTED IN:

Consensus is growing that natural gas will continue to fill a key role in a secure global energy future, and producers are continuing to strive for better environmental performance and greater transparency on impacts.

In recent years, this has translated into a growing movement to certify natural gas as “responsibly produced” using a number of platforms. In some cases, producers are opting for more than one certification process, to capture the most benefit from the “responsibly produced” label.

MiQ, considered the global leader in methane emissions certification, has certified about 20% of US natural gas production. MiQ grades natural gas on its methane emissions and awards a letter grade – from ‘A’ to ‘F’ – to assist in the differentiation of natural gas production and incentivise continuous improvement along the natural gas supply chain.

As of June 2023, MiQ’s methane standard had been used to independently certify 18 facilities operated by 11 of the biggest US natural gas producers, including EQT, Chesapeake Energy, BP and Repsol. All 18 were awarded a letter grade between ‘A’ and ‘C’, meaning they have a methane intensity of less than 0.20%, the threshold for receiving a passing grade.

For comparison purposes, the MiQ-Highwood Index™, which measures methane intensities along the gas supply chain, applies a methane intensity of 1% to US natural gas production, and 2.2% for the entire gas supply chain.

In October 2023, Gulfport Energy was added to MiQ’s list of certified producers, earning an ‘A’ grade on its 1bn ft3/day of Appalachian gas production.

Most of MiQ’s certification work is focused on the upstream and midstream sectors of the industry, but it has also developed a greenhouse gas (GHG) emissions framework to assess all emissions of methane, CO2 and NOX from the LNG supply chain. By the end of the year, it hopes to begin certifying LNG production.

Equitable Origin, another growing certification platform, measures the environmental impact of oil and gas production based on five principles – corporate governance, human rights, Indigenous Peoples’ rights, fair labour conditions, climate change, biodiversity and environment. Equitable Origin says it has certified about 12% of US natural gas production.

Like MiQ, Equitable Origin’s EO100 Standard for Responsible Energy Development (EO100™) issues a grade based on three levels of performance targets: PT1 indicates performance meeting industry best practices, PT2 indicates performance exceeding industry best practices, while PT3 indicates performance that leads industry best practices.

EO100™ certification produces a letter grade for site performance in meeting each of the five principles, with a minimum ‘C’ grade for each of those principles to achieve certification.

Alongside the original standard, Equitable Origin has developed technical supplements for onshore natural gas and light oil production, natural gas gathering and processing and natural gas transmission and storage, which is still in a draft stage.

Some of the largest gas producers in the US and Canada have been certified under the EO100™ standard, including EQT, Chesapeake Energy, ARC Resources, Equinor, Seneca Resources, Northeast Natural Energy, Vermilion Energy and Pacific Canbriam Energy.

National Fuel Gas Midstream earned its certification from Equitable Origin in October, becoming the first midstream operator to achieve EO100™ certification.

“Midstream is proud to set this industry milestone, as the first gathering operator to earn EO100™ certification, which reaffirms our commitment to implement best practices related to ESG standards throughout our Appalachian Basin operations,” NFG Midstream president Justin Loweth said. “We see this achievement as a step forward in our efforts to promote sustainability across our operations, transporting responsibly sourced energy to interconnections with pipelines that serve key commercial markets and end users.”

A third certification provider is Project Canary, which offers both a holistic environmental performance review for operators, covering air, land, water and community – its TrustWell 2.0 assessment protocol – and more recently a standalone low methane rating which assesses methane and carbon intensity, emissions best practices, monitoring techniques and technology and target setting to incentivise continuous improvement.

The TrustWell certification was originally targeted to natural gas production but has now been extended across the full natural gas production chain and has recently been introduced to the carbon capture and sequestration (CCS) sector.

Blockchain certification

The rise of natural gas certification platforms has opened the door to markets for certificates associated with responsibly sourced gas, with two platforms, CG Hub and Xpansiv, emerging as leaders.

CG Hub was launched in 2022 by COMET, an energy trading platform developed by TruMarx Data Partners, with collaboration from MiQ. COMET is the primary trading centre for some 6bn certificates in MiQ’s digital registry.

“The growth in the certified gas market has been rapid, and we expect to see the trading volumes rise as buyers are gaining a deeper understanding of how certified gas could contribute to their sustainability strategies,” MiQ CEO Georges Tijbosch says. “The ability to trade MiQ certificates on the CG hub provides a huge opportunity for buyers to choose lower emissions natural gas and demonstrate Scope 3 emissions reductions, and we expect other platforms to join imminently too. Having certified 20% of U.S. natural gas, we are moving closer to achieving our goal of eliminating oil and gas methane emissions this decade.”

Xpansiv, meanwhile, serves as a global market infrastructure provider for registering, managing, trading and retiring an array of data-driven environmental commodities, including certificates associated with certified natural gas. Through partnerships with Equitable Origin, MiQ and other certification providers, Xpansiv has registered more than 1.5bn ft3/day of Canadian production and is in the process of onboarding production from the Appalachian and Haynesville basins in the US.

Using blockchain technology, these registries separate physical gas molecules from certificates attesting to their underlying environmental data, allowing for the certificates to be distributed and traded separately. This expands the market and provides further incentive for producers to produce certified natural gas and other green gases.

Creating markets for certified gas

Enbridge Gas, Canada’s largest natural gas distribution company serving 3.8mn customers in Ontario, started down that road in November 2022, entering into a partnership to acquire 15 petajoues (PJ) of certified gas from US producer EQT.

Southwestern Energy (SWN), one of the largest dual-basin natural gas producers in the US, has entered into a multi-year agreement to supply German utility Uniper’s North American subsidiary with RSG from its Appalachia and Haynesville Basin assets.

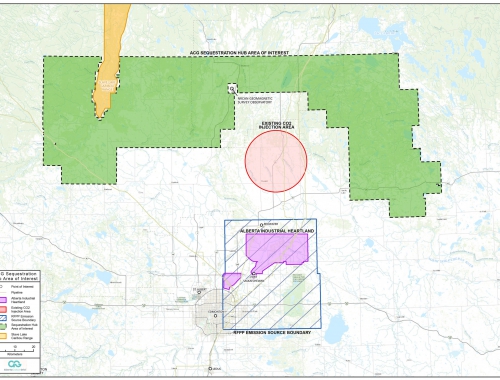

Privately-held energy company BKV Corporation of Denver has entered into a contract with France’s ENGIE for the sale and purchase of natural gas and associated sequestered carbon credits.

Under the agreement, BKV will deliver physical natural gas to ENGIE Energy Marketing as well as an equivalent amount of gas tokens that represent the environmental attributes associated with both RSG and captured CO2 from the gas stream that has been injected into a permitted facility owned by BKV.

BKV will sell credits to ENGIE associated with its Barnett Shale RSG production. [Image credit: BKV]

Olympus Energy has executed an agreement with Tenaska Marketing Ventures for the sale of its TrustWell™ certified natural gas produced in the Appalachian Basin and the transfer of Digital Natural Gas® certificates through the Xpansiv Registry.

Other gas industry participants – pipeline operator Williams, PennEnergy Resources, Chattanooga Gas and Repsol – have also entered into marketing arrangements for RSG, while CF Industries, a global leader in fertiliser production, is purchasing 2.2bn ft3 of MiQ-certified gas from BP.

MiQ says that using the ‘A’ grade certified natural gas as a feedstock in ammonia production would lower CF Industries’ natural gas supply chain-related scope 3 emissions by 90% and reduce the lifecycle carbon intensity by up to 20%, using a 100-year global warming potential. And using certified natural gas alongside carbon capture and storage (CCS) technologies could eliminate up to 94% of CO2 emissions associated with ammonia production.

Life cycle assessments

Natural gas certification initiatives, alongside growing markets for the trading of RSG-related environmental commodities, are critical components of the industry’s endeavours to make natural gas more sustainable in a secure energy future. And part of that process is providing transparency to the low emission credentials of natural gas – transparency that is even more crucial with moves by EU lawmakers to impose methane emission intensity limits on natural gas imported by its members.

US LNG developer Cheniere Energy is working with natural gas midstream companies, methane detection technology providers and leading academic institutions to implement quantification, monitoring, reporting and verification (QMRV) of greenhouse gas (GHG) emissions across its midstream supply chain.

The programme, at gas gathering, processing, transmission and storage systems along Cheniere’s supply chain, is intended to improve the overall understanding of GHG emissions and advance the deployment of advanced monitoring technologies and protocols.

And US engineering group McDermott has launched a web-based tool that helps energy firms better assess the carbon footprint of planned facilities before construction begins.

The tool, known as ArborXD, can be applied throughout an energy project’s life cycle, including at the concept, front-end engineering design and engineering, procurement, construction and installation phases. It provides McDermott’s customers with access to lifecycle footprint estimates, cost trade-off analyses, emission reduction pathways and environmental impact assessments.

Low emission LNG

As certification initiatives reach down the gas value chain, the next target will be certifying LNG production, transportation and regasification as sustainable.

Cheniere Energy has been a first-mover in this space, introducing cargo emission tags last year and joining the Oil and Gas Methane Partnership 2.0 (OGMP 2.0), the United Nations Environment Programme’s flagship methane emissions reporting and mitigating initiative.

OGMP 2.0 is a comprehensive, measurement-based reporting framework intended to improve the accuracy and transparency of methane emissions reporting.

Cheniere’s participation in OGMP 2.0 is another of the LNG producer’s climate strategy initiatives, alongside collaborative programmes to quantify, monitor, report and verify (QMRV) greenhouse gas (GHG) emissions across its supply chain. QMRV has been initiated at Cheniere’s Sabine Pass and Corpus Christi liquefaction terminals on the US Gulf Coast, and at natural gas transmission facilities it uses, consistent with the OGMP 2.0 reporting framework.

Cheniere has implemented an emissions monitoring programme at its Sabine Pass facility. [Image credit: Bechtel]

Meanwhile, Chevron delivered its first shipment of offset-paired LNG in late 2022. Emissions from the cargo, produced at the Gorgon project off the northwest coast of Western Australia, were fully offset through the retirement of high-quality, nature-based and energy efficiency offsets in Cambodia, Indonesia and Nepal.

And earlier this year, Singapore’s Pavilion Energy received its first LNG cargo accompanied by a statement of greenhouse gas emissions (SGE) from QatarEnergy at the Singapore LNG terminal. The SGE is a verified statement that quantifies the greenhouse gas emissions associated with producing and delivering the LNG cargo from the wellhead to the discharge terminal.